Payroll tax deduction calculator 2023

Talk To Our Employee Retention Credit Experts To Determine If You Are Eligible For Credit. Web Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time.

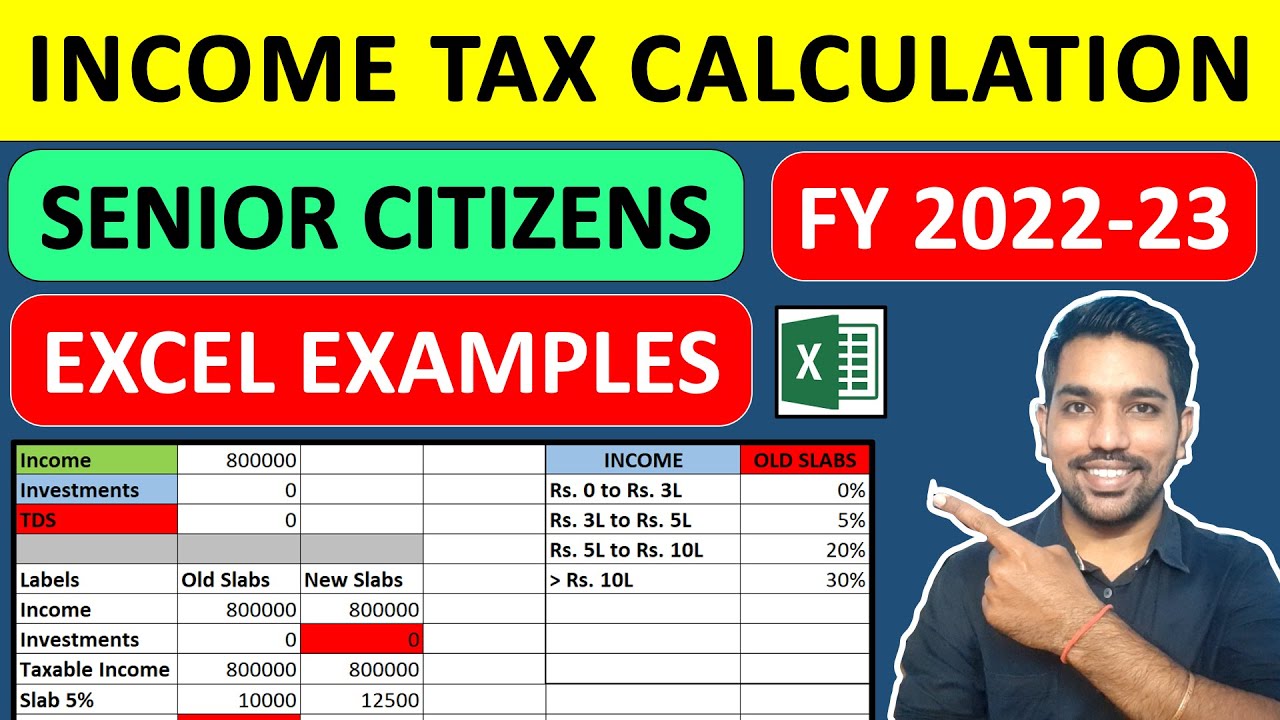

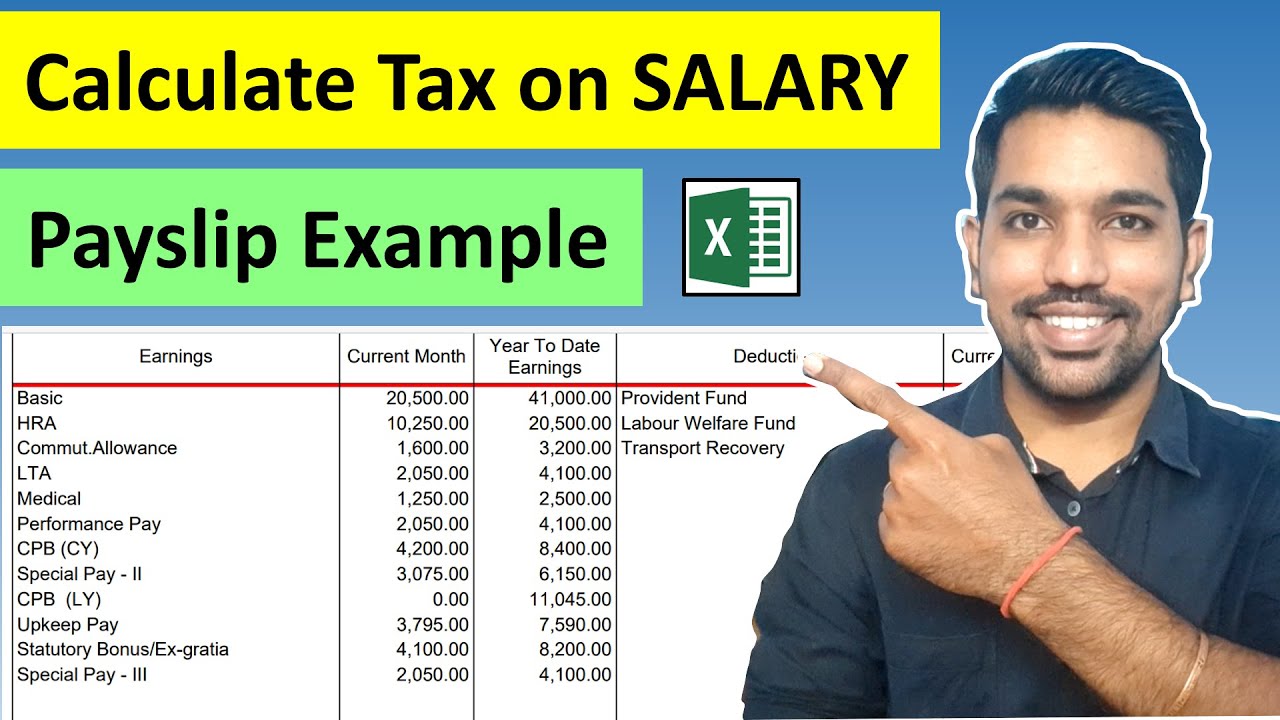

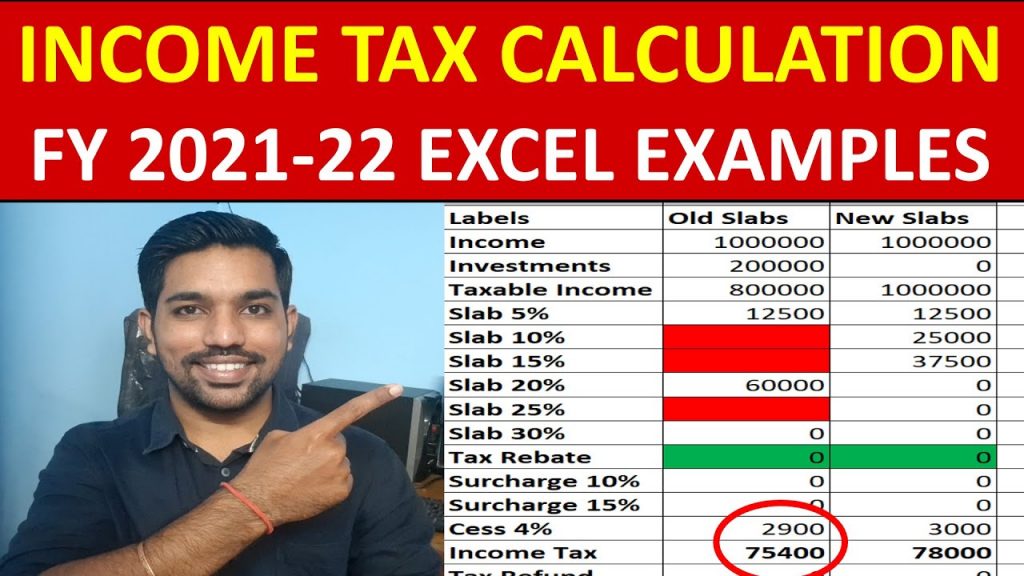

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

All Services Backed by Tax Guarantee.

. Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Web SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. Get Started With ADP Payroll.

Tax withheld for individuals calculator The Tax withheld for individuals. Web Use this simplified payroll deductions calculator to help you determine your net paycheck. Calculate how tax changes will affect your pocket.

This calculator honours the ATO tax withholding formulas. Unemployment insurance FUTA 6. Web The tax rate schedules for 2023 will be as follows.

It will confirm the deductions you include. Sign up for a free Taxpert account and e-file your returns each year they are due. Get a head start on your next return.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Updated for April 2022. Web 2023 Paid Family Leave Payroll Deduction Calculator.

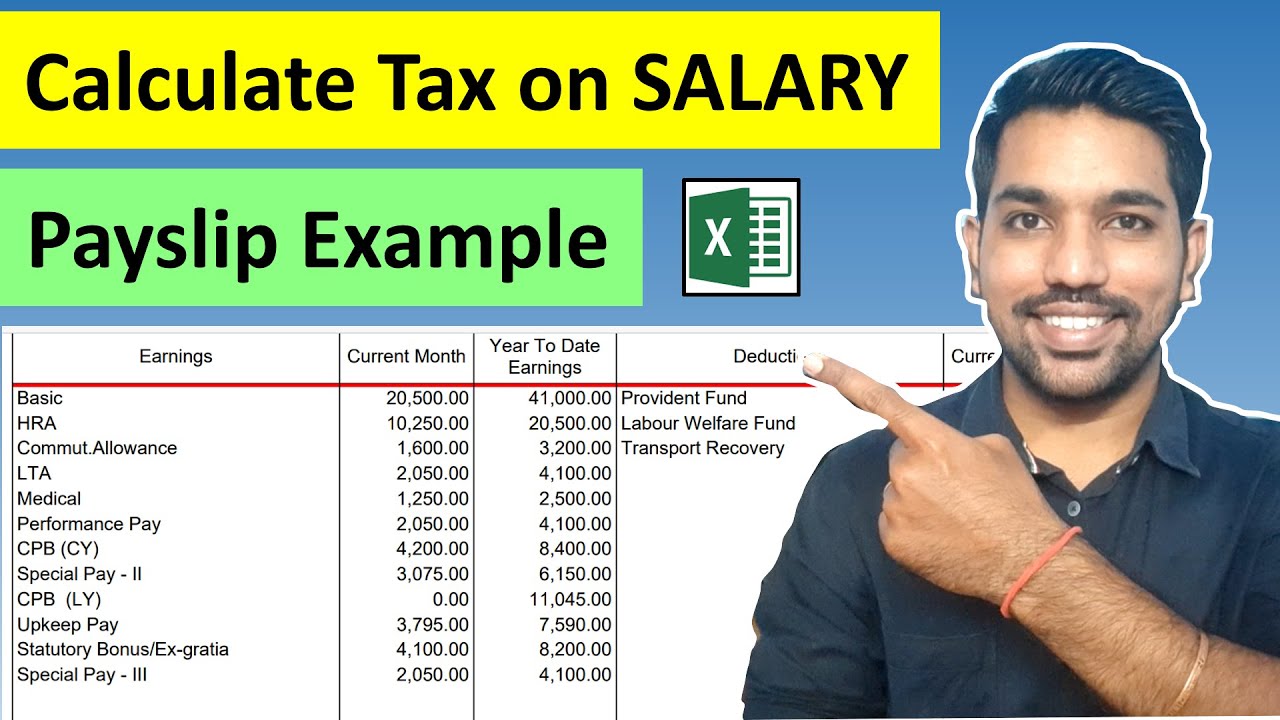

Employers and employees can use this calculator to work out how much. Subtract 12900 for Married otherwise. Web 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

2022 Federal income tax withholding calculation. Web Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Web This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data.

Ad Process Payroll Faster Easier With ADP Payroll. The standard FUTA tax rate is 6 so. Get Started With ADP Payroll.

Estimate your federal income tax withholding. Multiply taxable gross wages by the number of pay periods. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Compare This Years Top 5 Free Payroll Software. Discover ADP Payroll Benefits Insurance Time Talent HR More. The Salary Calculator has been updated with the latest tax.

Ad Compare This Years Top 5 Free Payroll Software. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Web This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Web It will be updated with 2023 tax year data as soon the data is available from the IRS. Web Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated. If taxable income is under 22000.

Start the TAXstimator Then select. Web 2021 Tax Calculator. Web The Salary Calculator - 2022 2023 Tax Calculator Welcome to the Salary Calculator - UK New.

Web Deductions from salary and wages. Web Choose the right calculator There are 3 withholding calculators you can use depending on your situation. Web FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication. We Recover 1M On Average For Clients. Web Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time.

Print a record of federal. Web Thats where our paycheck calculator comes in. Free Unbiased Reviews Top Picks.

Web Sage Income Tax Calculator. Use our PAYE calculator to work out salary and wage deductions. Ad The IRS Is Giving Businesses 26k per Employee.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan. Ad Process Payroll Faster Easier With ADP Payroll. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

Free Unbiased Reviews Top Picks. Web Begin tax planning using the 2023 Return Calculator below. Web 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

For married individuals filing joint returns and surviving spouses.

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

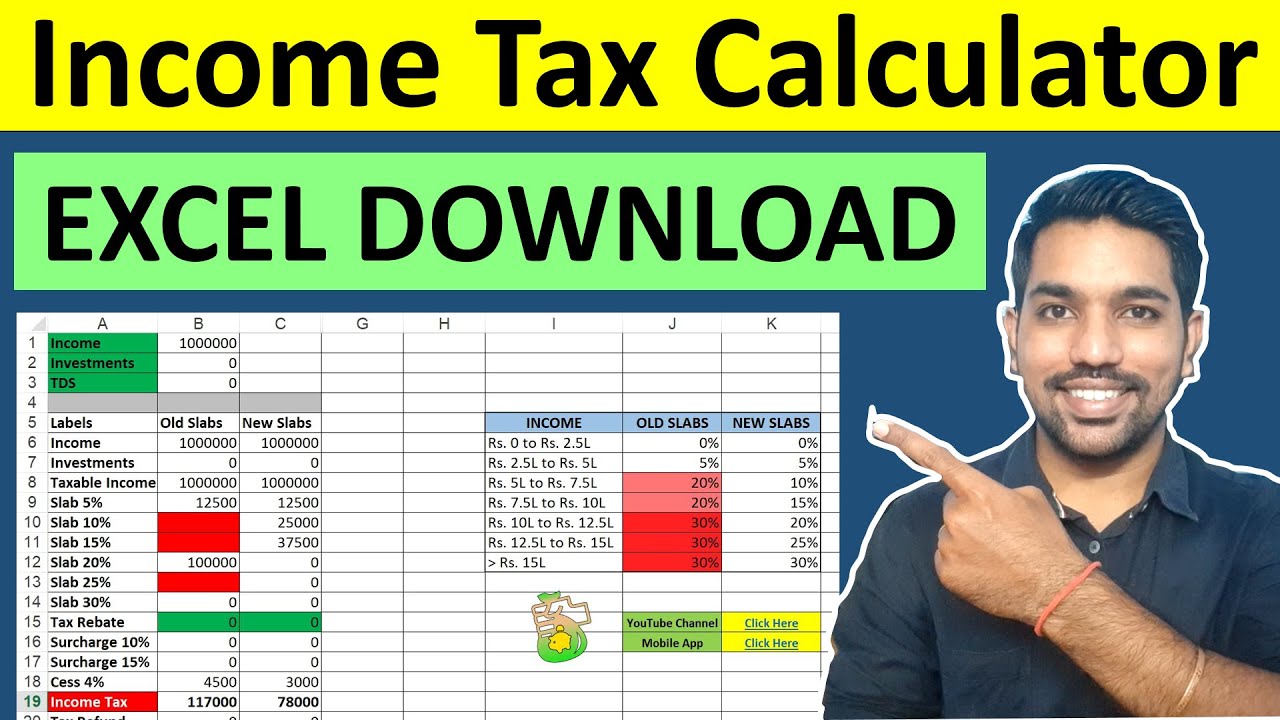

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Tax Calculator Estimate Your Income Tax For 2022 Free

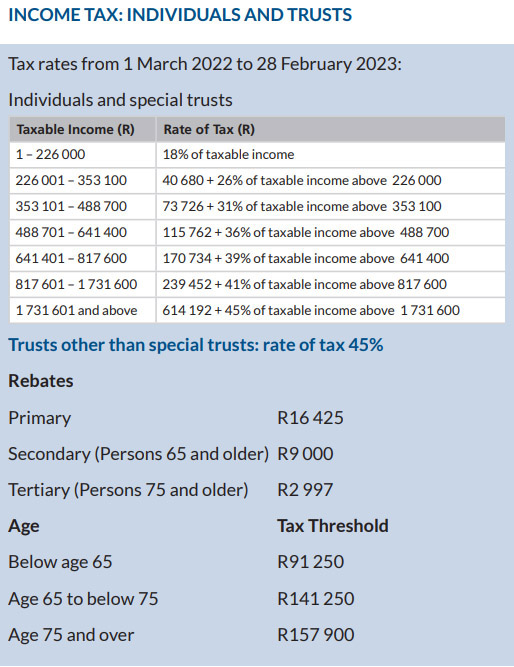

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

Llc Tax Calculator Definitive Small Business Tax Estimator

Income Taxpe Income Tax Payment And Education

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Pin On Budget Templates Savings Trackers

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

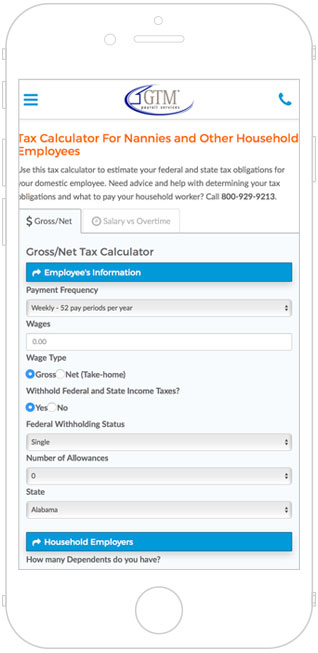

Nanny Tax Payroll Calculator Gtm Payroll Services

Resource Taxable Social Security Calculator

In The News Filing Taxes Tax Services Tax Return

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

Simple Tax Refund Calculator Or Determine If You Ll Owe

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube